Is There a Way to Automatically Upload Binance Order History to a Excel Sheet

How to connect Binance with Koinly

Are you trading with one of the world's biggest cryptocurrency exchanges? Whether you're buying, investing, staking, or storing crypto on Binance, it's incredibly easy to become your crypto taxes done with Koinly.

How to get a tax argument from Binance

You lot might exist wondering, does Binance provide CSV tax and trade history reports? Is information technology even possible to become tax info and statements from Binance? What nearly a Binance tax API? The good news is, while Binance might not provide tax forms and documents, Binance does offer 2 like shooting fish in a barrel ways to export transaction and trade history!

Binance pairs with Koinly through API or CSV file import to make reporting your crypto taxes like shooting fish in a barrel. Once connected, Koinly becomes the ultimate Binance tax tool. How? Koinly will calculate your Binance taxes based on your location AND generate your EOFY revenue enhancement report, all within 20 minutes! All you'll need to do at taxation fourth dimension is download your Binance tax statement from Koinly and file it with your local revenue enhancement authority. Done!

How does Koinly work with Binance?

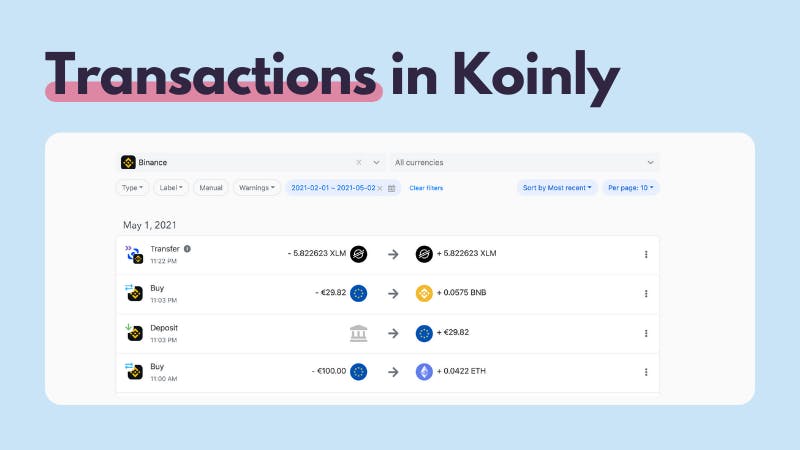

Koinly works by importing your Binance transaction data. Allow's look at an example - hither's some transactions in a Binance account.

You tin can import your Binance transaction history via API integration or by uploading CSV files of your Binance transaction history. Once yous've done this, you'll be able to see your Binance transactions in Koinly - like this.

This lets you manage all your crypto transactions - from Binance and any other exchanges y'all employ - from 1 single platform, making crypto taxation unproblematic. Hither's how to import your Binance transaction information.

Connect to Koinly with the Binance tax study API

On Binance

- Open the Binance API Management page.

- Select create revenue enhancement report API. (This is read-only past default.)

- Copy the API Key and API Secret.

On Koinly

- Sign up or login into Koinly and head to the wallets page.

- Add a new wallet: Binance.

- Paste the API key and API clandestine.

- Select secure import.

Good to Know

To create a tax report API in Binance, you lot'll need to have completed KYC first. Your Binance import may have a few minutes. That is normal. Once Koinly and Binance are continued you may detect a yellowish circle next to the Binance icon in your Koinly Wallet. Why? Koinly has calculated certain avails from the imported data and it'south non matching what the API is reporting on the exchange.

Don't worry, this is easy to fix. utilise the CSV file method. Binance API has certain limitations, for example, if you bought or sold using fiat. Read more most API limitations and alternate means to import missing datahere. Use the CSV file method.

How to import your Binance revenue enhancement report CSV file to Koinly

On Binance

- From your Binance account selectWallet and then Overview.

- SelectTransaction History.

- Now selectGenerate all statements.

- OnRange selectCustomize. Enter a first and cease date within a iii month period.

- SelectGenerate. Your argument might take a moment to generate.

- Repeat until your total trading history is covered

On Koinly

- Sign upwardly or login into Koinly and caput to Wallets.

- Add together a new wallet: Binance.

- Select CSV Upload.

- Upload all of your Binance CSV statements to Koinly.

Practiced to know

If y'all're using the CSV file upload method make sure to import your deposits, withdrawals and trades for ALL trading years and not simply the current year. Binance lets you download a maximum of one twelvemonth transaction history at a fourth dimension, and then you may need to export multiple CSV files to cover your consummate Binance trading history. This volition let Koinly to correctly calculate your taxable position. We have a dandy aid article for common issues with Binance CSV full of troubleshooting tips.

How do I bank check that my Binance import is accurate?

Our crypto tax software is pretty clever. However, if there are bug with the imported information, Koinly tin't generate an accurate tax report. This is why it's important you lot check through your Binance transaction history after you've imported your data - whether yous did this through API or CSV integration. Check your information import with these simple steps.

All wallets, exchanges and blockchains

Make sure you sync each wallet and exchange you utilize with Koinly. Koinly needs a complete overview of your crypto portfolio to brand accurate calculations. This is so it knows when you're only moving funds between your own wallets, as opposed to withdrawing funds or depositing them. This is of import considering moving funds around your wallets is taxation free, while withdrawals and deposits tin be bailiwick to Upper-case letter Gains Tax or Income Tax.

Look out for large numbers

One time you've got everything added, go to the transactions page in your Koinly account and filter by type, then filter to deposits and withdrawals. Check in that location aren't any which y'all call back are transfers betwixt your own wallets. If in that location are, prepare this manually.

Review the labels of your transactions

Next, use the wallet filter and select your Binance wallet. This is and so you tin can bank check the labels on your Binance transactions. Most of the fourth dimension, Koinly will import these automatically, but if there are whatsoever missing or wrong tags, you tin add them manually. These are important as they aid Koinly know what type of transaction it is and which tax to apply. Utilize the following tags:

Withdrawal Tags (sending funds):

A withdrawal is when yous ship funds, for example when you pay for something with crypto. This is what's known as a disposal of asset and information technology's often subject to Capital Gains Taxation. There are, nonetheless, instances when a withdrawal would be tax free. You can use tags to characterization these.

- Sent to pool: Tag any assets in liquidity/staking pools equally sent to puddle then Koinly knows you still own the nugget.

- Tag as gift: Gifting crypto is tax free in many locations. Check your country'due south crypto taxation rules and tag any gifted crypto.

- Tag every bit cost: Tag whatsoever transaction fees.

- Tag equally lost: Tag any stolen crypto and claim it every bit a loss, depending on your country's tax rules.

Deposit Tags (receiving funds):

A deposit is when you receive funds, for example, from an airdrop. Koinly looks at these as a purchase at market cost as standard, only there are many reasons you may receive crypto and some of these will exist field of study to Income or Upper-case letter Gains Tax. Y'all tin characterization these with eolith tags.

- Received from puddle: Utilize this tag to label the original majuscule y'all sent to a puddle, not any rewards as a consequence of it.

- Tag as mining: Most countries consider mining to be income, so it's subject to Income Tax.

- Tag as airdrop: Many tax offices run across airdrops as a bonus, making them field of study to Income Taxation.

- Tag as fork: Like airdrops, any new coins from a fork could be seen as a a bonus and subject to Income Tax.

- Tag every bit loan interest: Receiving involvement from loaning crypto is often seen as income and subject to Income Revenue enhancement.

- Tag as income: Similar any other salary, getting paid in crypto is subject to Income Tax.

- Tag as advantage: Apply this to tag any rewards from referral schemes, staking pools and so on. Rewards are often seen as a bonus and subject to Income Tax.

Commutation Tags (trading funds):

Trading crypto for crypto, selling crypto for fiat or buying crypto with fiat are exchanges and they're all taxed differently. Koinly calculates this for you based on where you live. Buying crypto is not taxed, selling crypto is always taxed and trading crypto is taxed depending on your location. There's only one uncommon tag you lot might need for an exchange.

- Tag every bit swap: If a cryptocurrency has changed its proper name/symbol, tag it as a swap. This is a tax complimentary transaction.

Yous tin can observe more communication on getting to grips with Koinly and crypto revenue enhancement reports in our Getting Started Guide.

How do I troubleshoot my Binance integration to Koinly?

We take a whole support section devoted to answering your most common - and not then common questions about our Binance integration. To give y'all a jumpstart, here are some of the questions we get asked most:

- My CSV file is missing information - help!

- My liquidity transactions are showing upwardly as withdrawals/deposits?

- Why aren't my futures transactions in my capital gains report?

See more than Binance assist in our give-and-take forum and experience free to jump on our chat if yous need a lilliputian more help.

Source: https://koinly.io/integrations/binance/

0 Response to "Is There a Way to Automatically Upload Binance Order History to a Excel Sheet"

Post a Comment